Over $900 million dollars was lost last year due to identity theft and fraud. It is no wonder security has become an increasingly important topic- especially when it comes to your financials. This has led to cumbersome processes and countermeasures being put in place just to try to protect customers.

Passwords must now be too complex to remember. Enrollment into a bank or service requires more personal information. In some cases, you must provide a random one-time code sent to your email or phone just to log in once. Luckily, OCR Solutions has the ability to streamline enrollment and login processes through ID Verification.

Facial Recognition

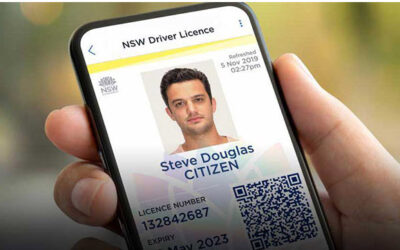

With OCR solutions identity management platforms, facial recognition is possible and is one of many ways banks can decrease friction in both the customer experience as well as increase accessibility/efficiency. Customers can be immediately recognized as part of a two-factor approach to logging in as well as enrolling in banking services.

When a facial recognition software captures your image, it is converted into a unique, digital biometric signature that cannot be easily recreated. This is due to the fact that there is an underlying algorithm that uses the dimensions of your facial features to generate it. All it requires is a customer to look at a camera (on their phone for example) and the software verifies the biometric against a database instantaneously!

Improved Security

Using a traditional password comes with a caveat- they are normally created based on what somebody knows. Hackers have the tools and tactics to obtain that information. Complex passwords also are easy to forget, so a temporary code may be sent to an email to reset it. This could be intercepted through a man-in-the-middle attack. Personal security questions can even be beaten with just a little research on someone.

Facial recognition authenticates users based on who they are as opposed to what they know. It adds a second factor for user authentication- having a specific device or knowing credentials being the first. Through a process called “liveliness detection”, advanced AI and machine learning algorithms are able to differentiate between a real person and simply a photo of you. This reduces the chances of someone using your photo to spoof your identity.

Facial recognition can also prevent hackers from opening fake accounts. If a bad actor walked into a bank to open a line of credit using a counterfeit license with someone’s real personal information, facial recognition during the on-boarding process would determine the individual is committing fraud.

Improve Conversions

Gone are the days where customers are required to fill pages of documents to verify their identity and enroll for banking services. The rise of digital forms and instant verification systems mean that people simply are not going to have the patience to work with institutions who employ traditional methods. A customer will want to be able to use the camera on their phone or computer.

OCR Solutions will take the on-boarding process and allow it to happen in minutes versus hours. A combination of AI, machine learning, human verification, and personally owned devices will deliver a fast, yet secure, experience for the end-user.

Let OCR Solutions Work for You!

From OCR software to facial recognition, no one does it better than OCR Solutions. Our experts will engineer a solution that works for your software platform and business. Facial recognition has been widely implemented, and customers expect businesses to provide a streamlined, yet secure experience. If you have any questions about facial recognition or our other products, do not be afraid to contact us today for a consultation!