Know Your Customer (KYC) software is a vital weapon for banks and other financial institutions to fight against financial crime and money laundering. Under the new rules imposed by the federal government, it’s no longer just good business for banks to know who their customers are, it’s considered an obligation. In this article, we’ll go over how KYC software can help banks comply with these rules and speed up the process.

1.Doubles Down on Customer Identity Verification

The government has made clear that the responsibility for banks knowing who their customers are lies with the financial institutions themselves. As such, not implementing and following KYC protocols will land them in hot water not only with the U.S. authorities but with forces from around the world.

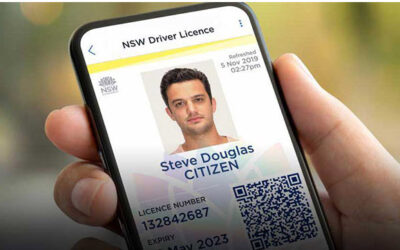

One of the most important components of the KYC process is to verify the identities of customers and their intermediaries, as well as ensure that these advisors themselves are who they claim to be. Before, this was done by simply checking a passport or driver’s license. As more people are conducting business online, especially due to the pandemic, this is less practical. Additionally, checking details manually is a long, tedious process that will cost time and money for everybody involved.

ID identification software vastly speeds up this process. Thanks to the biometrics capabilities of certain software solutions, financial institutions can rest assured that they’ll have the ability to know who they are in business with. This won’t just keep financial-centric companies from running afoul of the government, it will also help them take better care of their clients.

2. Ensures Funds are Legitimate

Besides knowing who customers and their advisors are, banks also need to know where their money is coming from. This refers to both individuals and business entities and can best be done through the use of a risk-based approach. In short, this approach has analysts look at how finances are structured to detect possible indicators of illegal money. Red flags to watch for may include:

- If the customer is based in a country with terrorist activity

- If the business is mostly cash-based

- If the entity in question has a complicated or opaque structure

Due Diligence

The combination of knowing your customer’s identity as well as identifying where their money comes from is part of the KYC due diligence process. Of course, subjecting every single customer to each step in this process could bottleneck any bank’s system which defeats the purpose. Luckily, a few solutions have been developed specifically for this reason:

- Simplified Due Diligence (SDD) is aimed at low-value accounts where risks of crime are minimal.

- Basic Due Diligence (CDD) is the standard or common process that all customers go through.

- Enhanced Due Diligence (EDD) is a deep dive when issues are uncovered during the CDD or if customers fit into any of the risk-based profiles mentioned above.

3. Encourages Ongoing Monitoring

The principles of the KYC process are actually quite simple. The difficulty lies not just in finding the information, but also in the need for financial institutions to check the details of each transaction. It’s not a one-time process, but a continuous one.

For example, an otherwise squeaky-clean client may suddenly have random increases of money pouring in, or receive a lump sum from abroad. These are things that may be indicative of transactions related to money laundering or terrorism. As such, banks need to have processes in place that monitor activity on an ongoing basis.

Compliant Software You Can Trust

Though continuous monitoring is crucial for all financial institutions, it’s a process that can consume both time and money at a rapid rate. While there once were limited solutions leaving organizations to either bear the cost or become vulnerable to threats, ID verification software and facial recognition programs have remedied this issue while also drastically increasing accuracy.

As a leader in the data capture space, OCR Solutions has garnered years of experience bolstering financial-centric institutions with tailor-made, efficient, and reliable KYC-compliant software. With a number of successful software implementations under their belt and reports of optimized business operations, it’s no wonder that those who work with OCR Solutions are confident that their safety and security systems are in the very best of hands.