As electronic data has developed enormous possibilities to gather and utilize customer data, have presented themselves to business operators. This is not limited to retail operations like big box consumer stores or post-sales data. Businesses have found that using Optical Character Recognition (OCR) software, in conjunction with scanners and cameras, enables them to gather a wide variety of data. This data can be used to streamline operations or match products and services to their customers and customer orders.

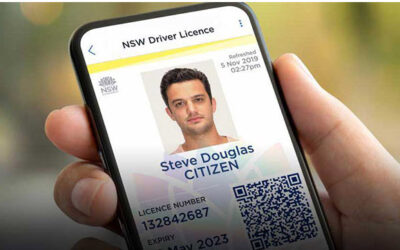

OCR is a type of software that can analyze text, such as a printed ID, and transform it into electronic data that a computer can process. Also, linking the OCR software into identification information databases allows for quick security checks of personnel entering facilities by scanning their driver’s licenses, passports, or even a business card. Let’s take a look at four types of facilities, some apparent and some not so obvious that benefit from fast identification reading using OCR software.

Airports/Ports and Government Offices

Everyone is aware of security measures at major transportation hubs in today’s world of heightened security. Finding ways to more quickly and accurately identify passengers, cargo, luggage, and match it to databases of customers and ticket holders simplifies all our lives.

Government offices also have this same need for quickly scanning visitor identification and matching the identification with databases, while also storing the data for possible retrieval if needed. But as you know, in both airports and government offices, security personnel are still checking identifications manually. Why is that?

Aside from the number of differently formatted forms of identification from different states and agencies, the RealID changes have also made it harder to read identifications electronically. Based on their long history in OCR development and integration, OCR Solutions has developed unique software to address these governmental issues.

Scrap Metal Recycling Facilities

This is an application that few people outside the scrap metal industry would readily think of regarding security and identification. Unfortunately, it is a fact of life that a prime target for thieves these days is abandoned buildings. Once they can gain access thieves strip out copper piping, electrical wiring, metals, water heaters, and other items. These materials can all be turned into money at scrap yards.

In most states, however, the proprietor of scrap metal businesses is required to positively identify people bringing scrap to sell to the scrap metal business. The business owner must examine a valid government photo identification, such as a driver’s license, passport, or other state ID. As with the data at government buildings and airports, this identification process and the data collected must be kept in a database in case law enforcement should need to access it later.

The scrap operator has to be able to comply with these laws and provide a clear record and copy of each sale. Scanning of documents allows the instantaneous gathering of the data from identifications and allows the ID data to be matched with receipts, invoices, and other business data to comply with documentation requirements.

Pawn Shops

Pawn shops are much like any other retail establishment that desires to collect customer data. Pawn shops also have the same motivations and requirements that scrap dealers have to identify people bringing items into their shop to sell.

The owners of the pawn shop have the same duty to identify the seller with a government photo ID as the scrap dealers. They must match their ID data to the item or items involved in the transaction. Then, the pawn shop must maintain copies of that data on record in case of a later investigatory need by law enforcement.

Financial Institutions

Financial institutions use IDs every day during routine transactions to verify who is accessing accounts or taking out loans and match that data to debits and credits on statements. One area that may be missed is the opportunity to utilize OCR software and scanner hardware from the first contact with the customer. Customer photo identification can be scanned, processed, and automatically analyzed to filter the information for account opening.

Think about the last time you opened an account at a bank for personal use or your business. How much time did you spend with the banking representative while they manually entered your information into their system and generated an account number to match to your information and open the account? Experience shows us that it takes 30 to 45 minutes to accomplish these tasks. By using OCR software and scanner hardware, data could be quickly scanned into the system. Electronic account information and authorizations could quickly be generated saving time and money for everyone.

OCR Solutions provides innovative software to extract data and streamline processes by harnessing the power of technology.

Thank you for reading our blog! How can we help you? Contact us today.