Checking Physical Identification Documents Can Help Prevent Auto Loan Fraud

Fraud is increasingly rampant in the auto loan industry, but experts say lenders can help protect themselves by requiring the use of physical identification documents rather than relying on just identification document numbers.

“The most underrated lending trend is fraud management in the auto industry,” Hyundai Capital America Chief Risk Officer Jennifer Kim told Auto Finance News. “Once fraud losses are recognized as credit losses, it results not only in the lender’s credit cost increasing but eventually the consumer’s cost going up as well.”

The Impact of Fraud on Auto Loans

Many vehicle purchasers use auto loans to pay for their purchases particularly these days when vehicle prices are at record highs.

But increasingly, auto lenders are dealing with fraud on an unprecedented level. In fact, in 2021, 1 in 5 lenders, out of 29 surveyed, indicated fraud was a serious issue for their organization, while another 50% considered fraud a moderate threat to their organization, according to the 2022 Auto Fraud Trends Report from Point Predictive.

“Auto lenders endured over $7.7 billion in exposure due to fraud and misrepresentation during 2021 — a 5% increase over 2020,” the report notes. “Those increased losses were driven primarily by increases in first-party fraud schemes such as income misrepresentation, paystub forgery, and employment fabrication as well as through more ‘professional’ means such as creating and using synthetic identities.”

Fraud can take several forms. It’s not just people who take out auto loans and don’t pay them back. Some take possession of the vehicle and then sell it or ship it overseas to be sold. Others don’t even use their loans to buy vehicles in the first place, but just keep the money.

Up to 70% of Early Payment Default (EPD) — defined as loans that default within the first six months — contain evidence of misrepresentation on the original application for that loan, according to the report. Moreover, 88% of lenders indicated that EPD was often the earliest indicator of missed fraud.

Where does all this fraud come from?

The Synthetic Identities Problem

Remember the movie The Sixth Sense, where the little boy said, “I see dead people”? In the case of auto loan fraud, the problem is not dead people (though sometimes they can be), but fake people, also known as synthetic identities.

Synthetic people aren’t androids or robots, but an identification history created using real information, just combined in a different way. “Typically, fraudsters use a combination of fictitious data from an actual person — or completely fabricated information,” writes Equifax, a consumer credit reporting agency. “For example, they may create a false person with a new name that has a real Social Security number or address.”

And it’s these synthetic identities or, rather, the criminals who are creating and using them that are behind the recent increase in auto loan fraud. In fact, Point Predictive reported that it found that in 2021 synthetic identity risk increased to 68 basis points. The number of synthetic applications doubled between 2020 and 2021 alone, from 38,225 to 76,418, and from $1.17 billion in loans to $2.85 billion, according to the report.

Synthetic identities ask for bigger loans, too. “In 2021, the average loan value for a synthetic was 68% higher than the overall average across the consortium,” the report notes. “This can be attributed not only to the boldness of synthetics as they become more prevalent, but the increase in car prices due to inventory shortages.”

Equifax estimates that as many as 210,000 accounts are potential synthetic identity fraud. With as much as $15,000 worth of bad balances per account, this amounts to more than $453 million to the greater auto lending industry. And because there’s no real person to report that their identity has been stolen, this fraud can take a long time to detect.

Ironically, COVID-19 in particular, government programs to help Americans grappling with the economic problems caused by the pandemic is what spawned the use of synthetic identities, as people used them to file for fake unemployment claims, fake government loans, and other government programs. Criminals discovered the same techniques they used to scam the government could be used to scam lenders after the government programs ended.

For example, a single person submitting 96 fake applications for more than $1.7 million in fraudulent auto loans, noted the report.

How Physical Documents Can Help

But synthetic people can’t walk into an auto dealership and ask for a loan that turns out to be fraudulent. Instead, these fraudulent loans often happen when someone applies online for the loan, using a driver’s license and other identification numbers that have been fabricated or stolen.

“More and more of the auto finance transaction and other financial transactions are taking place exclusively online,” writes Jim Henry in Forbes. “That means there may be no opportunity for a lender or an auto dealership to check an applicant’s identity in person — or even to verify that an applicant is a human being at all, as opposed to a ‘bot,’ software designed to mimic a bona fide loan applicant.”

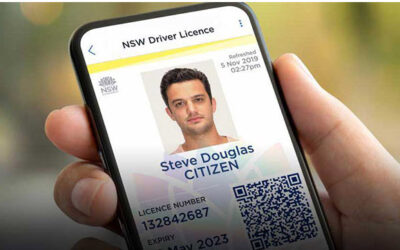

To combat this problem, lenders are increasingly asking borrowers to provide the actual physical identification document, such as the driver’s license, rather than just an identification number, as well as documents such as car registrations to prove that the funding would actually be used for a vehicle.

“In the days when consumers were required to come into a dealership or bank to obtain financing, judging the validity of an identification made ruling out some of these fraud types a bit easier,” writes Adam Davies in the FICO Blog. “An 18-year-old man can’t claim to be a 60-year-old woman without raising some serious red flags in person—but it’s easier to slip through the cracks online.”

How do lenders do this online? They’re asking potential borrowers to submit electronic photos or scans of their identification, registration, and similar documents, and upload them. Sometimes they require the hopeful borrower to include themselves in the photo, both to prove that they’re in possession of the physical document and that the photo on the identification looks like them. (At least, as much as any of us look like our driver’s license photo.)

“Chances are, if your onboarding processes for customers applying for credit do not include in-person verification of documents or biometric screening, you are exposed to synthetic ID fraud,” warns McKinsey & Company.

Interested in learning how optical character recognition can help your business protect itself by using physical identification documents? For a free trial of our API or software, please email us at [email protected].