[av_heading heading=’How Optical Character Recognition Assists in Invoicing Processes’ tag=’h2′ style=” subheading_active=” show_icon=” icon=’ue800′ font=’entypo-fontello’ size=” av-medium-font-size-title=” av-small-font-size-title=” av-mini-font-size-title=” subheading_size=” av-medium-font-size=” av-small-font-size=” av-mini-font-size=” icon_size=” av-medium-font-size-1=” av-small-font-size-1=” av-mini-font-size-1=” color=” custom_font=” subheading_color=” seperator_color=” icon_color=” margin=” margin_sync=’true’ padding=’10’ icon_padding=’10’ headline_padding=” headline_padding_sync=’true’ link=” link_target=” id=” custom_class=” template_class=” av_uid=’av-ky0dsttq’ sc_version=’1.0′ admin_preview_bg=”][/av_heading]

[av_textblock size=” av-medium-font-size=” av-small-font-size=” av-mini-font-size=” font_color=” color=” id=” custom_class=” template_class=” av_uid=’av-ky0djd9a’ sc_version=’1.0′ admin_preview_bg=”]

The OCR invoice process is capable of decoding information from documents and converting scanned image files or PDF files in an editable text format to accommodate verification processes.

Some businesses already use invoice generation tools, but they are merely limited to just generating invoices. These tools can neither process AP (Account Payables) workflows nor have the capacity for any AI automation solution processing.

OCR technology is a groundbreaking automated solution to error-prone problems like data entry and data manipulation. Paper processing has become a far-fetched notion to keep up with the highly variable trends of this world. How ineffective is it to manually add accounting and customer details into your accounting databases?

In the OCR process, there is no need to fill out the tediously long details of the customer’s credentials into the appointed fields. An OCR software, with an automated AI solution, will efficiently do it for your company.

Optical Character Recognition (OCR) Process

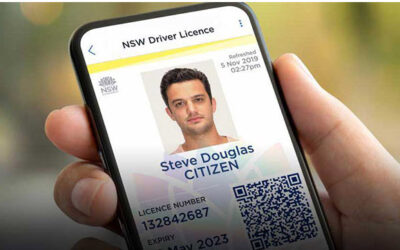

OCR in the invoicing process is applicable via digital & automated solutions that are hassle-free. It cross-checks accounting details and their verification online. It confirms and compares I.D photos and transactions with live camera images/videos. 100% verification proof of invoice with identity document is carried out, to foresee whether they are original or tampered with. The transactions are verified in the time span of mere seconds.

OCR technology converts digital information into editable formats to verify its authenticity. OCR in invoicing has already been generated in the e-billing process for the online payment of bills. Several industries use automated OCR software technology in electronic bills transfer (eBilling), tax payment, medical institutions, banks and many others. For instance, if your customer has demanded a huge sum of money transfer from your bank to another account. The OCR software process will have the leverage to scan these documents and make them editable for your verification process. Its multitudinous parameters can convert any type of document into an editable format.

OCR Software Invoicing

The automated derived invoice has the following customer invoice fields mentioned:

Invoice due payment date, Payable amount, Late fee Surcharge, Invoice Generation date, Details of products/services bought, company name and time of the purchase. Along with these fields, credentials of the customer’s name, ID card number, phone numbers, home address and email address are also mentioned in the verification process. This information can help the business in the KYC verification process.

A Vigilant Automated Solution

OCR software has the tendency to automatically compile and interpret invoice data. With the help of an AI and automated machine learning algorithms, it can process your invoice in a matter of seconds. Therefore it is highly time optimized, as it eliminates the working hours spent typing invoice data and making AP(Account Payable) workflows manually.

Invoice Error Discrepancies

Human interventions lead to human error. Several manual data entries could lead to manipulated account books which could adversely create fabricated financial reporting. OCR software in the invoicing process eliminates errors that could prove to be damaging to the company’s years built reputation.

AI Inbound Security

There is a high likely chance for the paper invoice to get stolen, manipulated or misplaced. An OCR automated solution saves the day to curb any security data breaches that could malign your customer base and prove to be a violation to your legal code of ethics. OCR technology provides ultimate fraud prevention with greater compliance to facilitate both the company and customer.

Efficient Invoice Search

After scanning invoice payable sheets, both the company and the client could have reliable access to the cloud repository with an internet connection. You can retrieve information at your disposal by a mere entering of a required invoice number, client’s name or any other private details mentioned in an invoice data.

AI Enabled Automated Solution

As the company’s production grows, so do the risks and the analytical measures to counter it. Verification of bundles of handwritten invoices could prove to be struggling and highly inconvenient. AI driven automated solutions come to our aid which can compare and cross-check authentic invoice account payables with its deep learning and artificial neural pathway and connections.

Optimizing – Cost, Time & Labour Constraints

Following account payable workflows manually is a time deficient process that could come at the cost of high labour-intensive tasks. Digital and automated (AP) OCR software can notably decrease the processing costs expended on Account payable processings and would efficiently be time productive for both the company and the customer.

Conclusion

OCR technology is an opportunity to behold if you want your company to be at the forefront of this highly competitive world. Eminent advantages could be extracted from this cutting-edge technology. In these passing years, OCR technology in invoicing has proven to be not only cost-efficient but also a significant profitable commitment for the company’s growth. It is a safe bet that we can have while dealing with the current dark powers of this web-based world.

[/av_textblock]