Financial institutions are no strangers to regulation. Banks, brokers, and insurance companies have seen numerous regulatory changes over the last two decades, with a focus on improving transparency, protecting against financial crimes, and ensuring liquidity. One such regulation is the Customer Due Diligence (CDD) rule, requiring covered financial institutions to establish and maintain written policies and procedures focused on customer identification verification.

The CDD rule is imperative in managing risk for institutions. It creates guidelines for proactively identifying customers and understanding the nature and purpose of customer relationships. Customer profiles, specifically, are important to understand, as illegal transactions such as laundering or funding of terrorist activity can lead to significant detriment. The CDD rule embodies the Know Your Customer (KYC) guidelines and has core requirements of identity verification, ongoing monitoring, and risk profiling.

While needed for financial institutions, this can be complex and seem fragmented if done alone. Here, we demonstrate how OCR Solutions provides a holistic approach to CDD compliance by combining ID verification, document scanning, and ongoing monitoring to build and maintain customer profiles.

Ensuring Legitimate Customer Identification

Customer Identification is the first step in CDD compliance as a large component of the regulation is ensuring that customers are who they say they are. This is especially crucial in financial services, where business entities and liabilities are attached to customers’ social security numbers and can affect the ability to purchase a home or apply for a loan.

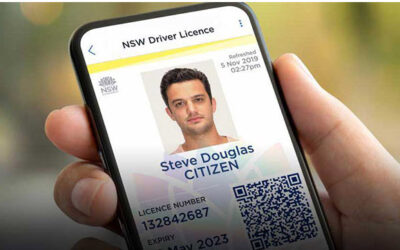

The reality is that traditional identification checks are subject to human error. Different forms of identification from varying states and countries make it difficult to ensure identities are correctly verified. By utilizing an automated method, like OCR’s idMax, financial institutions can reduce the margin of error and increase the resiliency of identity verification.

idMax accommodates all forms of identification from over 160 countries and attains a read 10x faster with more accuracy than any other system on the market. With the idMax solution, you’ll minimize your risk of misentered information or acceptance of falsified identification.

Maintaining Current and Accurate Records

The CDD requires financial institutions to understand the nature and purpose of customer relationships to determine if fraudulent or suspicious activity is occurring. To do this correctly and achieve true KYC compliance, they often collect documents like financial statements, operating agreements, or business addresses from customers to develop customer risk profiles.

Collecting and maintaining customer documentation can be extremely difficult to track and manage by hand, however. Manual document collection often leads to inconsistencies in data reporting and untimely collection of updated information. Additionally, documents of different origins and purposes can lead to confusion or overlooked information posing serious consequences for financial institutions. That’s why it is crucial to have a consistent, trusted solution for document scanning and data extraction.

Smart document automation tools like DocMax use sophisticated machine learning and character recognition algorithms to accurately capture and extract information from standard forms and files. To help maintain the integrity of the data, the system integrates specific business rules and lookups to ensure the information in the system matches what was extracted from the documents.

What was once a laborious, manual process, can now be extremely simplified. By accurately reading and organizing data quickly from millions of pages per year, solutions like DocMax enable financial institutions to cut down on labor costs and complexities at every corner.

Ongoing Monitoring

CDD and KYC compliance doesn’t stop after the initial identity verificationit’s an ongoing process that requires continuous efforts. As some customers may remain with financial institutions for long periods of time, it’s crucial to maintain consistent data collection for the entirety of the relationship. This means closely reviewing information consistently to ensure accuracy by utilizing a smart solution that has a built-in AI algorithm.

By integrating a highly-configurable facial recognition platform like the one offered from OCR Solutions, ongoing monitoring concerns can be easily remedied. With unique attributes like face mapping, anti-spoofing, and best-in-class accuracy, KYC compliance issues are no longer an area of concern. As an added bonus, OCR’s flexible licensing and competitive market pricing makes the software affordable and accessible to organizations of all shapes and sizes.

Supportive Partnership for Continued Success

Complying with the CDD rule requires multiple components that pose challenges to institutions. To ensure the CDD process is consistent across your entire organization, it’s important to partner with a company that can handle all touchpoints of compliance.

OCR Solutions provides the holistic protection needed to maintain CDD and KYC compliance. A partnership with OCR Solutions doesn’t stop after initial implementation as the OCR team prides itself on a hands-on, supportive partnership through the life of the relationship. As new technologies or regulatory changes arise, the OCR team provides seamless adaptation and integration for ongoing compliance.